Home → 360 → Printer Friendly Version

360

- 1. Release Notes

- 2. Getting Started

- 2.1. How to Log into Aristotle 360

- 2.2. VIDEO: Aristotle 360 Training Modules

- 2.3. Create Disbursements From File Menu

- 2.4. Ask a Question

- 2.5. Quick Search (Auto-Suggest)

- 2.6. Quick Search

- 2.7. Quick Search- Using Wildcard Character % to find Records

- 2.8. Selecting Filing Committee

- 2.9. 360 Hotkeys

- 2.10. Aristotle Technical Support

- 2.11. Getting Started Guide

- 2.12. Online Knowledge-Base

- 2.13. Definition of a Record

- 2.14. Deleting a Record

- 2.15. Saving a Record

- 2.16. User Permissions - Lowest Possible

- 3. Walkthrough

- 3.1. Walkthrough: Filing the FEC Form 6 (48-hour Notice of Contributions/Loans Received)

- 3.2. Walkthrough: Uploading Data from a Spreadsheet using Import Manager

- 3.3. Walkthrough: List Processing

- 3.4. Walkthrough: Manually Filing an FEC Report

- 3.5. Walkthrough: Accessing MDB/Microsoft Access Files

- 3.6. Walkthrough: Using the State Conduit Management tool

- 3.7. Walkthrough: I don't see the Election Period needed for my transactions

- 3.8. Walkthrough: I have multiple profiles for the same record - can they be merged?

- 3.9. Walkthrough: I don't see a record profile for a committee - how do I add one?

- 3.10. Walkthrough: How Do I Open a Full Database Export in Excel?

- 4. Action Center 3.1

- 5. Advocacy 3.1 - Regulatory Advocacy Administration

- 6. Homepage / Dashboard

- 7. Quick Entry

- 7.1. Create Disbursements From File Menu

- 7.2. Quick Entry

- 7.3. Quick Entry Hotkey

- 7.4. Steps to Enter Disbursements From Quick Entry

- 7.5. Steps to Enter Receipts From Quick Entry

- 7.6. Steps to Add an Entity to a Group in Quick Entry

- 7.7. Session Statistics

- 7.8. South Dakota - Entering Expenditure Transactions

- 8. Searching

- 8.1. Advanced Search

- 8.2. Advanced Search on Multiple Values (Cities, Counties, etc.)

- 8.3. Query Builder

- 8.4. Basic Search

- 8.5. Disbursement Search

- 8.6. Exporting a Saved List

- 8.7. List Manager

- 8.8. List Processing

- 8.9. Using List Manager to export Lists

- 8.10. Receipt Search

- 8.11. Current Selection

- 8.12. Steps to Use Quick Search to Create a List

- 8.13. Steps to Use Advanced Search to Create a List

- 8.14. Merging Two Records

- 8.15. VIDEO: Searching Your Database

- 8.16. Receipt Search by Deposited Date

- 8.17. FAQ: How to Export a List of "First Time" Donors Who Haven't Donated Before This Year

- 8.18. Current Selection - Selection Statistics

- 9. Searching - Quick Selections

- 10. Entities / Master Records

- 11. Entities / Master Records - Individuals

- 12. Entities / Master Records - Individuals - Householding

- 13. Entities / Master Records - Organizations

- 14. Entities / Master Records - Legislators

- 15. Entities / Master Records - Committees

- 15.1. Creating a New Committee Record

- 15.2. Adding a New Committee Record using the COSMOS Database

- 15.3. Creating a New Filing Committee

- 15.4. How to Add a Committee ID Number to a Record

- 15.5. Selecting Filing Committee

- 15.6. About Filing Committees

- 15.7. Filing Committee Basic Information

- 15.8. When Adding a RegID

- 15.9. Committee Staff

- 15.10. Linking a Legislator to Their Committee

- 15.11. Adding a Legislator to a Committee

- 16. Activity Management

- 17. Activity Management - Phone Call

- 18. Activity Management - Email

- 18.1. Mass Email Wizard, Brief Overview and Step 1

- 18.2. Mass Email Wizard, Step 2

- 18.3. Mass Email Wizard, Step 3

- 18.4. Mass Email Wizard, Step 4

- 18.5. Mass Email Wizard, Step 5

- 18.6. Mass Email Wizard, Step 6

- 18.7. FAQ: SPF Records for Mass Email

- 18.8. About Email

- 18.9. Sending Email

- 18.10. Tracking Email

- 18.11. Composing Email

- 18.12. Adding Images to Emails

- 18.13. How to Change Email Disclaimer

- 18.14. Email Statuses

- 18.15. Email Template Editor

- 18.16. Email Subscription Manager

- 18.17. HTML Editor

- 18.18. Finding Bounced Emails

- 18.19. Mass Email and Spam

- 19. Activity Management - Direct Mail

- 20. Activity Management - Fax

- 21. Activity Management - Task

- 22. Activity Management - Appointment

- 23. Activity Management - Mass Activity Wizard

- 24. Financial Transactions

- 24.1. Why Can I Not Add a Transaction To a Batch I Created?

- 24.2. "Force Itemize"

- 24.3. Creating a New Filing Committee

- 24.4. Creating Custom Election Cycles

- 24.5. Linking Two or More Transactions Together

- 24.6. Linking a Committee's Disbursement to a Legislator

- 24.7. FEC Form 3 Types and Subtypes Chart

- 24.8. FEC Form 3X Receipt Types and Sub-Types

- 24.9. FEC Form 3X Disbursement Types and Sub-Types

- 24.10. Reporting In-State Activity Only on a State Report

- 24.11. Entering Earmarked Contributions

- 24.12. TYPE: "Earmarked" vs. TYPE: "Earmarked (Conduit)"

- 24.13. South Dakota - Entering Expenditure Transactions

- 24.14. Adding an Unpaid Bill

- 24.15. Adding a Subvendor to an Expense

- 24.16. Refunding a Contribution

- 24.17. Voiding a Check/Disbursement

- 25. Financial Transactions - Receipts

- 26. Financial Transactions - Disbursements

- 27. Campaigns / Activity Campaigns

- 28. Events

- 29. Reporting

- 30. Reporting - E-Filing

- 31. Reporting - System Reports

- 31.1. Briefing Book Report

- 31.2. Disbursement Transaction List Report

- 31.3. Individual Details Report

- 31.4. Receipt Transaction List Report

- 31.5. Transaction Report

- 31.6. Contribution Analysis Report

- 31.7. Check Request Report

- 31.8. Total Receipts Per Election Period Report

- 31.9. Error Running System Event Contribution Report

- 32. Reporting - Compliance Reports

- 33. Lobby Disclosure Reports

- 34. FEC Compliance FAQs

- 34.1. How To Enter a Refund of a Disbursement

- 34.2. How To Adding a Joint Fundraising Committee (JFC) so that it appears on FEC Form 1 and Form 2 correctly

- 34.3. How To Enter a Reattribution vs. Redesignation

- 34.4. How To Enter a Redesignation

- 34.5. 35.2. Adding a Joint Fundraising Committee

- 34.6. How to Enter an Earmarked Contribution and the Accompanying Fee Disbursement

- 35. Reporting - FEC - Filing Committees

- 36. FEC Form 1 Compliance

- 37. FEC Form 2 Compliance

- 38. FEC Form 3 Compliance

- 38.1. Form 3

- 38.2. Proper Data Entry for Reattribution of Contributions on FEC Form 3 or 3X

- 38.3. Proper Data Entry to Forgive a Loan Made By the Candidate

- 38.4. Proper Data Entry to Record/Reimburse Campaign Expenditures Made by the Candidate as an In-Kind Contribution

- 38.5. FEC Form 3 Types and Subtypes Chart

- 38.6. Getting "Personal Funds" to Pull to Schedule C When the Loan Is From the Candidate (Form 3)

- 38.7. Calculating Election Cycle to Date and out of Period Transactions

- 38.8. FAQ: Why is my "Election Cycle To Date" amount zero for my earmarked memo entries?

- 38.9. FAQ: Why is "Candidate Name" pulling in the Campaign Name Field on my report?

- 38.10. FAQ: Why are my Earmarks Itemizing in two separate Periods?

- 38.11. FAQ: How to get memo entries when you receive multiple earmarked contributions through the same conduit on the same date

- 39. FEC Form 3P Compliance

- 40. FEC Form 3X FAQs

- 40.1. How Do I Enter An H2 Fundraising Allocation And Then Utilize That On An H4 Allocable Disbursement?

- 40.2. Why Are the Wrong Dates Loading on the Parameter Screen When I Select the Report Schedule?

- 40.3. I'm Seeing a Discrepancy in My Report's Year-To-Date Column - What Are Some Possible Causes?

- 41. FEC Form 3X Compliance

- 41.1. FEC Form 3X Parameter Screen

- 41.2. FEC Form 3X History Screen

- 41.3. FEC Form 3X Receipt Types and Sub-Types

- 41.4. FEC Form 3X Disbursement Types and Sub-Types

- 41.5. How to Generate and File an Amendment

- 41.6. Proper Data Entry for Reattribution of Contributions on FEC Form 3 or 3X

- 41.7. Pulling a Subordinate Committee to the Schedule F on the Form 3X

- 41.8. Data Entry for Independent Expenditures Disseminated in a Prior Period

- 41.9. Data Entry for Schedule H2

- 41.10. Data Entry for Form 3X, Schedule H3

- 41.11. FEC Form 3x - Line 30b

- 41.12. Entering Coordinated Expenditures as Debt Repayment

- 41.13. Schedule H(4) - Data Entry for Transactions to Pull With Previous Years Allocation Ratio

- 41.14. Schedule F: How to Show that Your Committee has been Designated to Make Coordinated Expenditures

- 41.15. FAQ: Why does my PDF only include the summary pages?

- 41.16. FAQ: How to Link Credit Card Memos to Outstanding Debts for Repayment

- 41.17. FAQ: Why don't my Debt Repayment memos show on Schedule D along with my Debt Transactions?

- 41.18. How to add a Presidential District

- 41.19. How do I enter an allocated transfer of in-kind contributions?

- 42. FEC Form 3L Compliance

- 43. FEC Form 5 Compliance

- 44. FEC Form 6 Compliance

- 45. FEC Form 24 Compliance

- 46. FEC Form 99 Compliance

- 47. FEC Report Troubleshooting and FAQs

- 48. Alabama Compliance Reporting

- 49. Alaska Compliance Reporting

- 50. Arkansas Compliance Reporting

- 51. Arizona Compliance Reporting

- 52. California Compliance Reporting (Legacy)

- 53. Colorado Compliance Reporting

- 54. Connecticut State Report

- 54.1. Schedule A - Itemized Contributions from Individuals

- 54.2. Schedule C1 - Contributions from Other Committees

- 54.3. Schedule C2 - Reimbursements or Surplus Distributions from other Committees

- 54.4. Schedule D - Loans Received This Period

- 54.5. Schedule K - Miscellaneous Monetary Receipts not Considered Contributions

- 54.6. Schedule L1 - Fundraising Event Information

- 54.7. Schedule L3 - Purchases of Advertising in a Program Book or on a Sign (Municipal Candidate and Town Committees ONLY)

- 54.8. Schedule M - In-Kind Contributions

- 54.9. Schedule P - Expenses Paid by Committee

- 54.10. Schedule S - Expenses Incurred by Committee but Not Paid During this Period

- 54.11. Schedule T - Itemization of Reimbursements and Secondary Payees

- 55. Connecticut Compliance Reporting

- 56. Florida Compliance Reporting

- 57. Georgia Compliance Reporting

- 58. Indiana Compliance Reporting

- 59. Iowa Compliance Reporting

- 60. Kansas Compliance Reporting

- 61. Maine Compliance Reporting

- 62. Massachusetts Compliance Reporting

- 63. Michigan Compliance Reporting

- 64. Minnesota Compliance Reporting

- 65. Mississippi Compliance Reporting

- 66. Montana Compliance Reporting

- 67. New Jersey R1 Report

- 68. New Mexico Compliance Reporting

- 69. New York Compliance Reporting

- 70. North Carolina State Report

- 70.1. Aggregated Contributions from Individuals (CRO-1205)

- 70.2. Contributions from Individuals (CRO-1210)

- 70.3. Contributions from Political Party Committees (CRO-1220)

- 70.4. Contributions from Other Political Committees (CRO-1230)

- 70.5. Refunds/Reimbursements to the Committee (CRO-1240)

- 70.6. Disbursements (CRO-1310)

- 70.7. Aggregated Non-Media Expenditures (CRO-1315)

- 71. Ohio Compliance Reporting

- 72. Oklahoma Compliance Reporting

- 73. South Dakota Compliance Reporting

- 74. Texas State Report

- 75. Texas Compliance Reporting

- 76. Utah Compliance Reporting

- 77. Virginia Compliance Reporting

- 78. Reporting - Custom/QRT Reports

- 79. Bank Accounts / Accounting

- 79.1. Creating a Batch

- 79.2. Creating a New Filing Committee

- 79.3. Creating a Bank Account

- 79.4. Selecting Filing Committee

- 79.5. About Filing Committees

- 79.6. Filing Committee Basic Information

- 79.7. Bank Accounts

- 79.8. Types of Bank Accounts

- 79.9. Bank Account Reports

- 79.10. Reconciliation Report

- 79.11. Outstanding Checks Report

- 79.12. Disbursements Report

- 79.13. Outstanding Receipts Report

- 79.14. Saving Committee Staff and Relationship Links

- 79.15. Viewing Committee Staff and Relationship Links

- 79.16. Using the Disbursement Budgeting Feature

- 79.17. Creating a New Disbursement Budget

- 79.18. Viewing Budgeting Disbursements

- 79.19. Exporting Disbursement Budgeting Data

- 79.20. Printing Checks

- 79.21. Bank Reconciliation Guide

- 80. Bank Accounts / Accounting - Checks

- 81. Administration

- 81.1. Creating a New Filing Committee

- 81.2. Selecting Filing Committee

- 81.3. Account Settings

- 81.4. My User Settings

- 81.5. Add/Edit Users

- 81.6. User Permissions

- 81.7. Edit Record Groups

- 81.8. Edit Election Periods

- 81.9. Edit Transaction Limits

- 81.10. Global Transaction Defaults

- 81.11. Edit Receipt Sources

- 81.12. User-Defined / Custom Fields

- 81.13. About Filing Committees

- 81.14. Disbursement Budgeting

- 81.15. Check Status Settings

- 81.16. Email Template Editor

- 81.17. Email Subscription Manager

- 82. Groups

- 83. Fundraising/Advocate Administration

- 84. Fundraiser/Bundler Management

- 85. Super Voter

- 86. Fat Cats

- 87. Importing Data

- 88. Batches

- 89. Notes

- 90. Release Notes

- 90.1. Aristotle 360 Release Notes - June 2012

- 90.2. Aristotle 360 Release Notes - May 2012

- 90.3. Aristotle 360 Release Notes - March 2012

- 90.4. Aristotle 360 Release Notes - February 2012

- 90.5. Aristotle 360 Release Notes - November 2011

- 90.6. Aristotle 360 Release Notes - September 2011

- 90.7. Aristotle 360 Release Notes - August 2011

- 90.8. Aristotle 360 Release Notes - June 2011

- 90.9. Aristotle 360 Release Notes - May 2011

- 91. Compliance Q&A

- 92. Aristotle 360 API

- 92.1. User Permissions/Setup Required for API Usage

- 92.2. Getting Started with the Aristotle 360 API

- 92.3. Creating Entities and Transactions Using the API

- 92.4. Example Web Application Using the 360 API

- 92.5. Creating New Individual With Email Information (Sample)

- 92.6. getList() Method

- 92.7. API XML String Return Value

- 92.8. Add/Update Individual Employer

- 92.9. Adding Individual to a Group

- 92.10. Add Individual to a Group by Specifying Group and Category Names

- 92.11. Add Individual and Receipt Info

- 93. Aristotle 360 API - Fields/Field Mapping

- 94. Webform Builder

- 95. Bills and Votes

- 96. Fly-In

- 97. Sharepoint Sites

- 98. Release Notes Links

- 98.1. 360 Release Notes - January 2017

- 98.2. 360 Release Notes - February 2017

- 98.3. 360 Release Notes - March 2017

- 98.4. 360 Release Notes - April 2017

- 98.5. 360 Release Notes - May 2017

- 98.6. 360 Release Notes - June 2017

- 98.7. 360 Release Notes - July 2017

- 98.8. 360 Release Notes - August 2017

- 98.9. 360 Release Notes - September/October 2017

- 98.10. 360 Release Notes - November 2017

1. Release Notes

1.1. 360 Release Notes 2017

In Production Now!

1.2. 360 Release Notes 2016

1.3. 360 Release Notes 2015

1.4. 360 Release Notes 2014

2014 Election Data: Transitional Contact Data for 2014 General Election Winners

1.5. 360 Release Notes 2013

1.6. 360 Release Notes 2012

Aristotle 360 Release Notes - June 2012

Aristotle 360 Release Notes - May 2012

1.7. 360 Release Notes 2011

2. Getting Started

2.1. How to Log into Aristotle 360

- Browse to https://ai360.aristotle.com/

- Type in your Username

- Type in your Password

- Click Login

* Be sure that your pop-up blocker is disabled for the Aristotle 360 website.

2.2. VIDEO: Aristotle 360 Training Modules

These recordings walk you through the common features used in Aristotle 360. They are between 6 and 18 minutes long. To view these recordings you will need to download a .zip file containing the recordings and also containing the recording player software, which will need to be installed on your Windows computer.

To download the file containing the recordings and player:

- Click this link: http://webdownload.aristotle.com/360trainingmodules.zip

- Enter the username: webget

- Enter the password: $uppli54

After downloading and extracting the file the folder contains the following recordings:

- Logging on and User Setup - 6 Minutes

- 360 Layout and the 4 Record Types - 18 Minutes

- Groups and Notes - 9 Minutes

- Filing Committee and Accounts Pages - 10 Minutes

- Batches, Transactions, and Periods - 17 Minutes

- Import Manager - 10 Minutes

- Using Search and Lists - 12 Minutes

- Exporting Data and Running Reports - 10 Minutes

You will be able to double click these files to play them after installing the atrecply.msi file on your Windows computer.

2.3. Create Disbursements From File Menu

This method of data entry allows you to create a Disbursement without having to access the entitiy record or load quick entry. This is useful for entering one Disbursement.

One way to enter a new Disbursement is to go to File > New Disbursement. This will cause the Disbursement Edit pop out window to appear. Once the Disbursement Edit window appears you will be able to enter the information for the Disbursement. After entering in all the information for the Disbursement select Save and Close. This will save the Disbursement to the record that you selected and close the Disbursement Edit window.

2.4. Ask a Question

By going to Help > Ask A Question. you are given the opportunity to fill out a short form and submit it to Aristotle Technical Support. This feature is useful if you don't have immediate access to your e-mail client.

2.5. Quick Search (Auto-Suggest)

In the upper left-hand corner of the Home Page you will see the Quick Search. Here you have the ability to search for a particular record in your dataset.

To do this, enter in the full name or partial name of the record. Records that match the criteria you input will automatically show up below the input field. Continue to enter as much of the record's Full Name as possible. Once a record of interest appears, select the record by clicking it once or moving your keyboard arrow keys until your record is highlighted and pushing ENTER. Aristotle 360 will navigate you directly to that record's "Detail" page.

Please note that the Quick Search automatically searches across all four entity types at once; Individual, Organization, Committee, and Legislator reords. The icon that appears to the left of the entry designates the type of record you are viewing. Move your mouse arrow above an entry for a tooltip hint on the type of record you are looking at.

The Quick Search is located on the upper left-hand corner of almost every page you go to, not just the home page.

* If you wish to use the legacy Quick Search module instead of the Auto-suggest quick search, please contact Aristotle Support for a change in your dataset's configuration settings.

2.6. Quick Search

In the upper left-hand corner of the Home Page you will see the Quick Search. Here you have the ability to search for a particular record in your dataset.

To do this enter in the full name or partial name of the record and select what kind of record it is (Individual, Organization, Committee, or Legislator). Then click the Quick Search button. This will cause a fly out window to appear with possible matches for the record name you entered. Once you find the name of the record you want in the list that appears, click on it to view the record.

Tip: If you have trouble finding a record, try broadening your search by only typing in the first name or only the last name, you can also type in the partial first or partial last name if you are unsure of the spelling.

The Quick Search is also located in the upper left-hand corner of almost every page you go to, not just the home page.

2.7. Quick Search- Using Wildcard Character % to find Records

Donor name formats vary to include initials and middle names at times, for example a donor whose provided formal name is "J. Thomas Smith" might introduce himself informally as "Thomas" making it difficult to locate his donor record. This is a situation where the wildcard % will come in handy.

By default, Quick Search uses a starts like command to search records, so "J. Smith" and "Thomas Smith" will get you different results. Using % in place of unknown parts of a name will return additional records that contain part of what you're searching. So for the example above if I type "%Thomas Smith" into quick search I will find the J. Thomas Smith record.

2.8. Selecting Filing Committee

You can have one or more filing committees in a dataset. You set up the info for the filing committee on the Filing Committees page by going to Settings > Filing Committees. Select the filing committee you wish to review or edit by clicking on the magnifying glass next to the name of the filing committee.

2.9. 360 Hotkeys

By clicking on the Hot Keys Guide from the 360 menu bar under Help, list of available hot keys are presented in a legend.

In order to activate these hotkeys, press and hold down the Control Key, the Alternate Key and the corresponding letter key at the same time and in that order.

GLOBAL HOTKEYS

Cntl+Alt+H --> Go to the Homepage

Cntl+Alt+A --> Go to the My Open Activities View

Cntl+Alt+I --> New Individual

Cntl+Alt+O --> New Organization

Cntl+Alt+L --> New Legislator

Cntl+Alt+M --> New Committee

Cntl+Alt+Q --> Open Quick Entry

Cntl+Alt+P --> Help Manual

Cntl+Alt+S --> Individual Basic Search

Cntl+Alt+Y --> Organization Basic Search

Cntl+Alt+E --> Legislator Basic Search

Cntl+Alt+C --> Committee Basic Search

Cntl+Alt+R --> Create New Receipt

Cntl+Alt+D --> Create New Disbursement

Cntl+Alt+X --> Logout and Close Session

Record-Specific Hotkeys *

Cntl+Alt+R --> Create New Receipt

Cntl+Alt+D --> Create New Disbursement

Cntl+Alt+N --> Create New Note

* Must have a specific record open for hotkey to execute

2.10. Aristotle Technical Support

By clicking on Aristotle Support Hompage from the 360 menu bar, you are redirected to the Aristotle corporate website (http://www.aristotle.com/content/view/76/103/).

Aristotle Technical Support is available 24/7 throughout the year. The two best methods for contacting a technical support representative are:

1. Send an e-mail to support@aristotle.com with your dataset name and a detailed description of your issue.

2. Call 888 217-9600

3. Ask a question here: http://support.aristotle.com/kb/contact/

In order to receive prompt and courteous service, please use the two methods above. Please have your customer identification number and dataset number handy when you contact Aristotle Technical Support.

2.11. Getting Started Guide

By clicking on the Getting Started Guide from the Help menu, you are redirected to Aristotle 360 Knowledge Base. Here you can browse for an article or subject area you need help with.

2.12. Online Knowledge-Base

By clicking on the Online Knowledge-Base from the Help menu, you are redirected to Aristotle 360 Knowledge Base. Here you can browse for an article or subject area you need help with.

2.13. Definition of a Record

In a database, a record is a collection of specific, uniform information related to, or clearly defining, a single item or entity. In Aristotle 360, there are four types of Records: Individuals, Organizations, Legislators, and Committees.

Types of Records

- Individuals: This type contains information about specific people, such as contributors, staff members, volunteers, and constituents.

- Organizations: This type typically contains information about all of the organized groups you work with except those that qualify as Committees (below). Examples of your Organizations may include your vendors, employers, businesses that contribute, and banks.

- Legislators: This type contains information about elected officials at all levels, for example U.S. Senators and Representatives, Governors, members of State Legislatures, County Commissioners, and local elected officials. This record type is populated and updated by Aristotle resources.

- Committees: This type typically includes those organized groups whose primary function is to influence, or participate in the political process. Examples of Committees include Political Action Committees, Political Party Committees, State Party Committees, Campaign Committees, and other types of political committees.

2.14. Deleting a Record

If your administrator has set permissions for your dataset, you may not be able to delete records. In this case, the Delete option will be grayed-out and you cannot select it. When you need to delete a record from your database, first search for and select the record you want to delete, then click the Delete option on the Options Bar. A dialog box appears asking you to confirm that you want to delete the record, and you must click OK to complete the process.

2.15. Saving a Record

When you finish entering and proof-reading data, click the Save Changes option (or Save and Close) on the Options Bar to make your changes permanent. You can click Save at anytime while entering information, but always be sure to save when you finish entering data. Each time you save an Individual record, you'll see a confirmation. Note: if you are inside the Address Information box or any one of the panes below (Receipts, Disbursements etc), you must click the save button within that pane in order for the information to save. If you enter in an address and click save at the top of the page, the address will not save.

2.16. User Permissions - Lowest Possible

The Lowest possible user permission allowed is that of a User with a new group that you create. Once you assign this new user to the new group, do not give them any permissions. One thing they will be able to access is add and delete records with non-financial information. The new users would also be able to access Webform Builder. Other than that, a user with no permissions cannot do anything to any financial records. They would basically be able to "Read-Only" when given no permissions.

3. Walkthrough

3.1. Walkthrough: Filing the FEC Form 6 (48-hour Notice of Contributions/Loans Received)

Filing the FEC Form 6 (48-Hour Notice of Contributions/Loans Received)

For information about who must file a Form 6, and when it must be filed, please see the FEC website: http://www.fec.gov/pdf/forms/fecfrm6i.pdf

When filing a Form 6 using Aristotle 360, you will use the manual uploader to file the report, instead of filing it directly through the system. This help file will walk you through this process.

Generating your Form 6

1. To generate your Form 6, mouse over the Reporting tab and choose "Compliance Reports." For Filing Authority, choose "FEC," then click the "FEC Form 6"

.jpg)

***Please note: if you do not see this option, and you need to file a Form 6, please contact Support for assistance.***

.jpg)

2. Fill out the three tabs and click "Generate:"

a. Accounts: Choose the correct filing committee and bank account(s).

b. Form Information: Enter the date range for your report

c. Settings: Additional options for the report

Downloading your Report and the Vendor Tools

1. When the report has finished generating, you will see a pop-up with four choices:

.jpg)

a. To download a viewable version of your FEC file (PDF): Click the Print button. This will bring up your document in a viewable format.

b. To download your FEC file: click on the first link (Click on ____ to download your FEC file) to download and save your FEC file (e.g. "Sample Form 6"). Be sure to save it somewhere you can locate again (such as "My Documents" or the Desktop).

c. To view your validation file: click on the second link to download your validation file (Click on _____ to download the report generated by the FEC). This will inform you of any warnings or errors with your report.

d. To download the Vendor Tools: click the third link (Click here to download Aristotle Vendor Tools): you will need to do this only once. After clicking on the Vendor Tools link, save the file to your computer:

e. Locate the saved file. Right click on the file, and choose "Extract All," "Unzip," or similar.

Filing Your Form 6

1. Once it has extracted, open the unzipped file you just created (it should now have a normal folder icon, not a zipped one). You will now see a series of folders and files.

2. Open the FECload folder, then double-click the FECload icon to open the program.

3. Click File > Upload. Locate your FEC file ("Sample Form 6").

4. You will now need to enter your e-filing information.

a. ID: Enter your FEC Filing ID it should be formatted like this: C12345678

b. Fax: typically not necessary

c. Password / Confirm: type your e-filing password. Please note, if you do not know your FEC e-filing password, you will need to contact the FEC we do not have this information.

d. Email 1 / Confirm: the email address where you would like to receive the receipt confirmation.

e. Email 2 / Confirm: a second email for the confirmation (if desired)

5. Choose "TCP/IP" as the filing method.

.jpg)

6. Click the Configure tab at the top. **Note: you will not be able to click Configure until you have entered the information above.** Enter the following information:

a. TCP/IP hostname: disclose.nictusa.com

b. Agency ID: FEC

.jpg)

7. Confirm that your information is correct, and click OK. The upload process will begin immediately. Please DO NOT close the FECload program until:

a. You receive an email confirmation from the FEC, letting you know that they have received your file, and/or:

b. You receive a pop-up notification in the FEC uploader with a "Success!" message.

Please note: if you are unsure of whether or not your report was successfully uploaded, you can always check its status on the FEC website using your committee name and/or committee ID to search: http://fec.gov/finance/disclosure/efile_search.shtml

Please check the FEC website *before* attempting to file again.

3.2. Walkthrough: Uploading Data from a Spreadsheet using Import Manager

The Import Manager allows you to import a group of records and/or transactions into your database in a single operation. By mapping the columns of your import, you have great flexibility with the format of your import file, and you can save your import settings for use again and again. If you plan to import files using the same format and structure then it is to your advantage to save your settings so that you will not be required to go through the entire wizard with each import.

Starting the Import Wizard

To find the tool, head over to the Tools tab on the navigation bar. If you are using the old 360 layout, you can find the tool under the File menu.

From there, click on the green Start New Import button.

Step 1: Select Your Data File

Click Browse to search your device for the data file you want to use for the import.

Once you have selected your import file, choose the following:

- Import Type (what record type will be created for your import file)

- Import Title

- Description

Note the check box: be sure to un-select this if your first row contains data rather than column headers.

Step 2: Confirm Your File

This step displays information about your import file, including some sample data from the first few rows of the spreadsheet. Review this to make sure you have chosen the correct import file and settings.

The File Options selection will allow you to begin on a line other than the first line if desired.

Step 3: Map your Datapoints

In this step, you will select which fields you want to import and where that data should be imported.

- Source Column will display your column headers (if you indicated that your file contained column headers).

- Source Preview will show you sample data. You can choose the blue arrow at the top to select a different data line to view.

- Field Data Type will allow you to choose the type of data you are importing for each field. Your choice here will affect what shows up in the Destination Field drop-down.

- Destination Field will let you select exactly where the data should be mapped.

Step 3.1: Assign Default Values (Organizations)

If you are importing organizations, you will see a screen for step 3.1, where you will need to select a default organization type. The type is required for organization data entry, and the selection you make here will apply to all records from your spreadsheet. Alternatively, if you don't want a single organization type to be applied to your entire import, you can include it as a column on your spreadsheet, which will be mapped out on the initial phase of step 3, seen above.

Step 4: Assign Default Values

Step 4 will change depending on what type of information you have mapped for your import. In this step, you will determine what the system will fill in for any missing information.

For example, when importing receipt information, you must set some receipt-specific defaults if you have not already mapped these fields in your import.

You can also add these receipts to an existing batch or create a new batch for the import. Please be aware that a batch must still be an open batch (i.e. not have a closed date saved to it) in order for it to appear as an option here.

We recommend always using a batch when importing transactions; performing tasks such as mass editing or mass deleting transactions from an import is much easier when they are in a batch together.

Once you have set all the defaults you need, click Next.

Step 4A: Assign to Groups / Step 4B: Assign to List

You will also have the option to import all records into a Group. If you check the "Import Groups" check-box, you can select a group by first choosing a Category, then selecting the correct Group.

If you need to add a Category or Group, you can also do so from this screen.

In addition, you can assign all records to a list by using the field and button in this section to create a new list.

Step 4C: Assign to UDF

On this step, you have the option to assign records to UDFs. Please note that the UDF options will only appear once the Import UDFs box is checked.

Please note that steps 4A through 4C are all optional, and can be skipped if desired.

Step 5: Record Matching

In this step, you will select how Aristotle 360 will match your imported records to your pre-existing records. You will also determine what Aristotle 360 will do with matching and non-matching records.

Adding New: choose what you would like the system to do with records for which it cannot find a match the screen-shot shown is for an import of individuals.

- "Create Non-Existing Individuals" this will create new records for those that do not match others in the database.

- "Ignore Non-Existing Individuals" this will skip over all records that do not match other records in the database they will not be imported.

Updating Existing: choose what you would like the system to do with records that it is able to match.

- "Update Individual Info" this will insert your newly imported information into matching pre-existing records.

- "Do Not Update Individual Info" this will ignore all of your newly imported information for individuals who already exist in the database.

Matching Criteria: The options on this list will change based on what information you are importing and mapped back in Step 3. For example, since we imported First Name, Last Name, and Address Line 1, the second option is available. Because we did not import a Voter ID, we cannot choose to match by Voter ID.

Final Step

Save Settings: This will allow you to save your import settings to use later. This is very helpful if you will be importing the exact same file structure repeatedly. If saving your import setting to use at a later date, be sure to click Save Settings before finishing your import otherwise your import settings will not be saved.

Email Notification: Enter your email address. The Import Wizard will send you an email when the import is complete.

Click Finish to complete your import.

After Completing the Import Manager Wizard

You should receive a confirmation email letting you know the results of your import. Please be aware that there may be some delay, depending on the size of your import.

Congratulations! You have successfully completed your import. We recommend that you spot check some of your imported records to make sure that all of your fields were mapped correctly. If you have any questions, or if you need any assistance, please contact Support.

If you saved your settings during the final step of the wizard, you'll find those settings when you navigate back to the Import Manager page.

Keep in mind that if you plan to use these same import setting again, you will click on the format name instead of the green Start New Import to begin your import. When using saved settings, remember that your new import file must be in the same format as your original import, i.e. the file must have the same number of columns as the original, and they must all be in the same order as well. If the new file has the same columns, but in a different order, then certain datapoints may get imported into the wrong field.

3.3. Walkthrough: List Processing

List Processing can be a very helpful tool when attempting to combine various kinds of information to create new lists. This tool gives you the ability to expand or narrow any list by including or excluding certain information using other lists that you have created in your database.

Creating your Lists

1. To use List Processing, you will need to create two or more lists that you will manipulate to achieve a unique list. You can also use any existing list that you have previously saved in your database. A list can be created whenever you have a selection of records usually created by using the Search tab.

You can use any of these search options to find a list of records.

2. Once you have entered your search parameters and searched the database for records that match your criteria, you will have a list of records, with a "List Functions" box on the right-hand side.

3. Under List Functions, click Save Results as New List and enter a name for your list. Follow the same steps to create your second list, and any other lists you might be manipulating. Once you have created all of your lists, you are ready to use List Processing.

List Processing

1. Mouse over Search and choose List Processing. You will see a screen with a Venn diagram, and a number of options. These options will allow you to combine your lists in any way.

2. Click on the text box under List A to select your first list by searching for the name. Do the same for List B. Please note that for the "Difference" option, the order of your lists will matter, while the order for the "Join" and "Intersection" will not - this will be explained further.

For example, let's assume that List A is all donors in your database ("All Donors"), and that List B is all individuals with a home address in Oregon ("All Oregon Residents").

a. Join: selecting "Join" will create a list that contains all records from both lists. In our example, this would give you a list of all donors and all Oregon residents.

Please note: a record can only appear on a list one time. This means that if a record belongs to both List A and List B, it will still appear only once on your newly created list.

b. Difference: selecting "Difference" will create a list that contains all records in List A that are not in List B. All members of List A that also belong to List B would be removed. In our example, this would give you a list of all donors except those that live in Oregon.

Please note: as mentioned before, the order of your lists for Difference is very important reversing the two lists would give you a different result.

In this example, you would create a list of all Oregonians who did not donate, whereas in the first list you created a list of all donors except Oregonians.

c. Intersection: selecting "Intersection" will create a list of only those individuals who belong to both lists. In our example, this would give you a list of all donors in (and only in) Oregon.

3. Once you have made your selection and named your new list, click Process and Create New List. You will now have a new list saved in your List Manager (also under the Search tab) both of your original lists will be retained.

3.4. Walkthrough: Manually Filing an FEC Report

Manually Filing an FEC Report Using FECload.

There may be a time when you will need to file your FEC report outside of the 360 software, such as when using a back-door password to change a report type or date range. The steps below will guide you through using the FEC's Upload tool. To manually upload your report, you will need the upload software provided by the FEC. It can be found here: http://www.fec.gov/elecfil/vendors.shtml

If you already have the FEC software downloaded, please skip to step II.

I. Downloading and Unzipping the FEC Vendor Tools.

When downloading, choose "Save" to save the files to your computer. Locate the file where you downloaded it you will see a zipped folder icon. Right-click, and choose "Extract All."

.png)

Once the file has been unzipped, you will see three folders. We recommend that you do not save any files to, nor remove any files from this folder, as it can disrupt functionality.

You are now ready to file your report.

II. Filing Your Report

- Open the "FECload" folder, then double-click "FECload" to open the program.

1. Click File > Upload. Locate your FEC file ("Sample FEC Form").

2. You will now need to enter your e-filing information.

a. ID: Enter your FEC Filing ID it should be formatted like this: C12345678

b. Fax: If you would like a faxed confirmation, enter your fax number here. This is not necessary.

c. Password / Confirm: type your e-filing password. Please note, if you do not know your FEC e-filing password, you will need to contact the FEC we do not have this information.

d. Email 1 / Confirm: the email address where you would like to receive the receipt confirmation.

e. Email 2 / Confirm: a second email for the confirmation (if desired)

f. This filing amends: If your file is an amendment, enter the Filing ID of the original report. This must be in the format FEC-123456, and it must be the filing ID of the original report. For example, if you are filing a second amendment, enter the original report ID, not the report ID of your first amendment.

3. You have two options for e-filing your report: TCP/IP and SSL. Each of these will need specific information added to the "Configure" tab please note, this tab will not be available until you have entered all of the information in Step 2.

Please note: the two possible filing methods are equivilent, the choice of one over the other has only to do with your network settings. Normally TCP/IP is sufficient. If you receive a message on-screen stating that TCP/IP was unable to connect then you may wish to try SSL. Please note that your local network administrator may need to configure you network security to allow connections. The configuration tab should contain all of the information your network administrator will need.

a. For TCP/IP, enter the following information:

i. TCP/IP hostname: disclose.nictusa.com

ii. Agency ID: FEC

b. For SSL, enter the following information

i. Port: 80

ii. HTTP(s): https://webforms.nictusa.com/cgi-bin/disclose_ssl/upload

iii. Agency ID: FEC

4. Confirm that your information is correct, and click "OK." The upload process will begin immediately. Please DO NOT close the FECload program until either:

a. You receive an email confirmation from the FEC

b. You receive a pop-up notification in the FEC uploader with a "Success!" message.

Please note: if you are unsure of whether or not your report was successfully uploaded, you can always check its status on the FEC website using your committee name and/or committee ID to search: http://fec.gov/finance/disclosure/efile_search.shtml

Please check the FEC website before attempting to file again.

3.5. Walkthrough: Accessing MDB/Microsoft Access Files

Below is an introduction to using Microsoft Access to search an .mdb export. First, a word about the file's export structure: Each separate entity (receipts, disbursements, individuals, etc.) has a unique string that "names" it. This string is called a GUID. This string is used to link each table, so 360 (or Microsoft Access) can tell which receipts belong to which individuals.

For example, the "Individuals" table has a column named "ind_GUID." This column holds the GUIDs for each individual. The "Receipt" table has a column named "entity_GUID." This column holds the GUID for each receipt's contributor. If the value in a cell in the "entity_GUID" column matches a value in a cell in the "ind_GUID" column, then that receipt is from that individual.

Microsoft Access is able to link tables together to make this information usable via a feature called Query Design. Here are the steps to use this feature:

1. Click on the "Create" tab, then click "Query Design." In the resulting pop-up window, select the tables you want to pull information from.

2. Link the tables by clicking the GUID field in one table and dragging it onto the matching GUID field in another table. A line will appear connecting the two fields. Below the tables, you can select the fields you want to appear in your output by selecting the table name and field name for each column. (The order you use to connect the fields doesn't matter; all that matters is which fields you connect and which you choose to use as output fields.)

3. Once you've made your selections, click the "Run" button at the top of the screen.

4. You can sort or filter your results just as you would in Excel.

5. To export your data to Excel, select the "External Date" tab, then click the "Excel" button in the "Export" section. Then follow the steps provided.

3.6. Walkthrough: Using the State Conduit Management tool

This tool is used to streamline the data entry process for committees that serve as conduits. The tool can be found under the File menu; if you don't see it there, it likely has not been enabled for your account. If you are interested in using the tool, please reach out to your Sales Rep and/or Account Manager for more info.

How to use the Tool

- Before starting, you'll need to make sure that you already have receipt entries created for the individuals that made contributions to your conduit committee for the purpose of being disbursed. Those receipt entries will add to each individual's balance. For this walkthrough, we'll be using the three examples below:

- Once you have receipts to be disbursed, go to File > Conduit Management Tool. From here, you'll be able to search for an existing disbursement, or create a new one. We'll go ahead and create a new one using the option on the right.

- Enter all of the details for the disbursement. This entry will represent the funds going from your conduit committee to the recipient committee.

- The next step will be to select all of the individual receipts that will be included in this disbursement. Start by checking off the appropriate records and then hitting the Select Individuals button.

- From there, choose how much of each individuals' balance to attribute to this disbursement. Note that the available amount reflects the records' total balance, based on all of the contributions they have made; you can attribute all of the available amount, or just a portion of it.

- Also, note that when the attributed total does not equal the amount we indicated on the previous screen, you'll only have the option to Save Selected Transactions. This option will not allow for the disbursement entry to be created within your 360 database.

- When your total attributed amount does equal the amount you indicated for the disbursement on the previous screen, then you'll have the option to create the disbursement entry and link all of the individual transactions to it.

- Once the disbursement has been created, the tool will create a disbursement that has all of the options you entered back on step 3. In addition, the system will also create and link the necessary conduit memos on the individuals' records. The amount of these memos (i.e. the amount attributed within the tool) will reduce each record's total available balance, so you won't be able to attribute those same funds for future disbursements. Once that disbursement is created, you should be finished! The disbursement should now be ready for your compliance report.

Additional Notes

- If you delete that disbursement, note that it only deletes that specific entry - the conduit memos created by the tool that are saved the individuals will still exist. If you need to delete that disbursement, you should go back into the tool, use the searching fields on the left to find the disbursement, and then use the delete option.

3.7. Walkthrough: I don't see the Election Period needed for my transactions

When a new election cycle or new calendar year begins, you may see that the election period needed for that cycle/year does not appear as an option when you create transaction entries. This is simply because one has not been created yet - the ones you see are likely the default periods that were created when your database was first set up, or were created by a previous user.

Creating New Election Periods

New periods can be created at any time by taking the following steps:

1. Go to Settings > Add/Edit Election Periods

(Settings will be on the navigation bar if you are using the old layout)

2. Click the Add new period button at the bottom of the page.

3. Fill in the Text and Date fields.

- Text: This should be the type of election. The most common choices would be General, Primary, or Other, but the text can be tailored to your specific needs.

- Date: This should be the year of the election cycle/calendar year.

4. Click Insert. This button will save the period, and you can begin selecting it in your transaction data entry.

Optional Steps

5. Default Check box: checking off this box for a particular period will make it so that period is pre-selected whenever you create new transaction entries. If you expect most of your transactions will go to a specific election for the foreseeable future, you can mark this box.

For example, if you know most of your transactions for the next year or so will be for the Primary election, you can mark that one as the default so you won't need to select it every time.

6. Edit Period Limits: You can click here to adjust the amount that your committee can receive or disburse to a record. These limits are based on the type of record.

For example, if you can only receive $10,000 worth of any type of receipt from an individual in a single election period, you can set the receipt limit to that amount. If an individual has $10,000 worth of receipts already saved to their record for that period, and you attempt to add another, then the system will give you a limit warning, and you won't be able to save that transaction unless you return to the Periods page and raise that limit. This can be done for disbursements as well; if your committee can only donate up to a certain amount to another committee per period, then you can set that limit as well.

These limits allow you to more easily keep track of how much your committee has received or given for compliance purposes.

3.8. Walkthrough: I have multiple profiles for the same record - can they be merged?

When you find that you have duplicate record profiles, they can be merged into a single profile. Just follow these steps:

Merging Record Profiles

1. Run a search (using any method) that includes both records in its results.

2. Once you are on the results page, check the box next to the records to be merged. You can merge multiple records at a time, so if you ever find that you have 3 or more records for the same entity, you can merge them all at once.

3. Click the Merge Selected Records option on the right side of the page.

4. That will open up the merge window. From here, select the record that you want to designate as the primary record.

- The way that merging works is that the primary record will be retained, and any data, like contact info or transactions, from the other record(s) will be transferred to the primary. Once that data has been transferred over, the other record(s) will be deleted.

5. Click the Merge button.

Additional Merging Info

Be absolutely sure that records are duplicates for the same entity before merging, as a merge cannot be undone. Some situations where records can appear to be duplicates, but are not, include:

- A father and son have the same name, but their profiles may or may not have the proper suffixes (Jr./Sr.) selected.

- Two individuals may share a common first and last name

- Some organizations may have facilities in multiple locations that operate independently of each other.

If a merge is performed erroneously, the only way to return the records to their original state would be to create a new record for the one that was not marked as primary, and then copy data from the primary to the newly created record. If there were any transaction entries, you'll need to open those, and reassign them to the new record as well.

3.9. Walkthrough: I don't see a record profile for a committee - how do I add one?

If you don't see a record for the committee, you'll have to go ahead and create one. There are two ways to do so:

Method A: The easiest way method of creating a new record would be to go to Quick Add (new layout) or File (old layout) and select the Committee option. That will open up a new profile, where you can enter the committee's info. Once you save the record, you'll be able to add transactions to it.

Method B: The second method involves a few more steps, but can take less time overall. This method only possible for federal committees; if you need a profile for a state or locally registered committee, you'll need to use the first option.

- Go to Search > Committee Search > Basic Search. From here, enter the committee's name, and then run the search. Since there is no profile for the committee, you'll likely have no results.

- Right below the "Selection Results", you'll see another section called "Possible Committee Matches from COSMOS Database". The COSMOS database is an external data source that houses info for committees that are registered with the FEC, and you can load info from that database into your Aristotle database. At this point, you should see the Escobar committee in that section.

- Click on the name of the committee, and a new window will pop up. From there, you'll see more of the committee's info, as well as a few buttons. The first two will allow you to immediate create a profile for that committee. Go ahead and click one of those options, and you should now have a profile for the committee, and can begin entering transactions.

3.10. Walkthrough: How Do I Open a Full Database Export in Excel?

Full database exports are provided in as a Microsoft Access database (.accdb) file. These types of files can still be opened within Excel by following these steps:

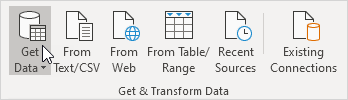

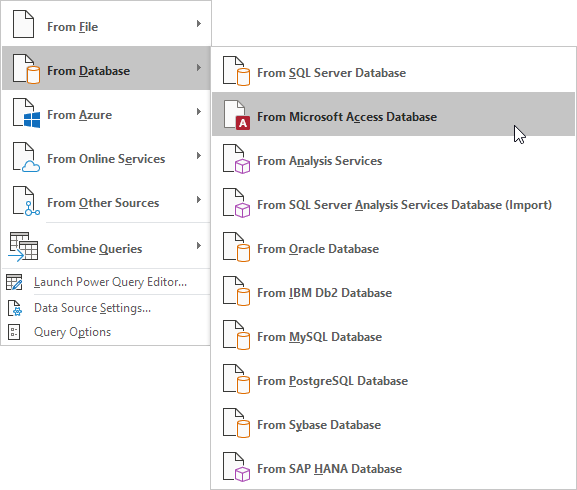

- Click on the Data tab and then click on Get Data

- Click From Database and click From Microsoft Access Database

- Navigate to and select your file.

- Click Import.

- You'll see a list of all of the tables within that database file along the left side. Tables can include items such as individual records, receipt entries, etc. Select the one you are interested in opening, and click Load.

From there, you should be able to view your data or save it as a different file type, such as .XLSX or .CSV.

- The contents of that table will then load into the current sheet.

4. Action Center 3.1

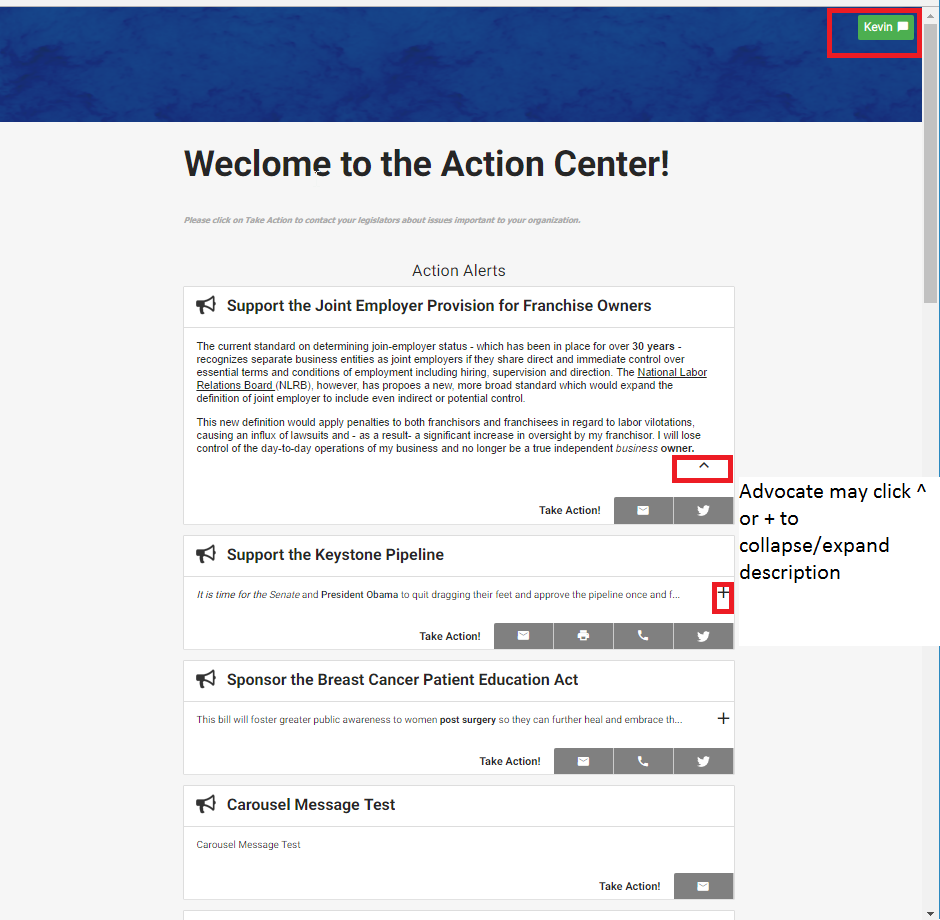

4.1. Action Center 3.1 User Experience

Action 3.1 Advocate Experience

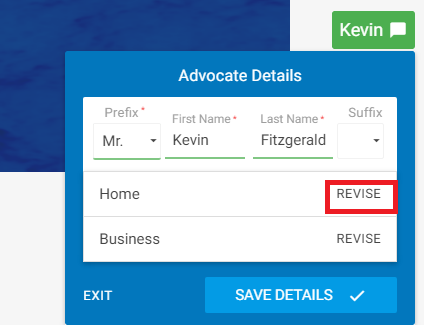

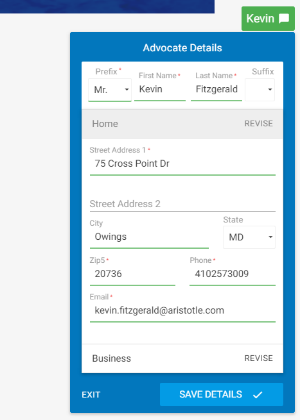

Action Center 3.1 simplifies the workflow for the advocate when participating in an action alert. After logging or registering the advocate will select the method they wish to take action either Electronic (Email/Webform are now unified), Fax or by Phone. Once selected, they will use that specific workflow in the alert. This eliminates the multiple decision points the advocate must make and permits them to quickly execute the intended action.

Action 3.1 Advocate Experience

Action Center 3.1 simplifies the workflow for the advocate when participating in an action alert. After logging or registering the advocate will select the method they wish to take action either Electronic (Email/Webform are now unified), Fax or by Phone. Once selected, they will use that specific workflow in the alert. This eliminates the multiple decision points the advocate must make and permits them to quickly execute the intended action.

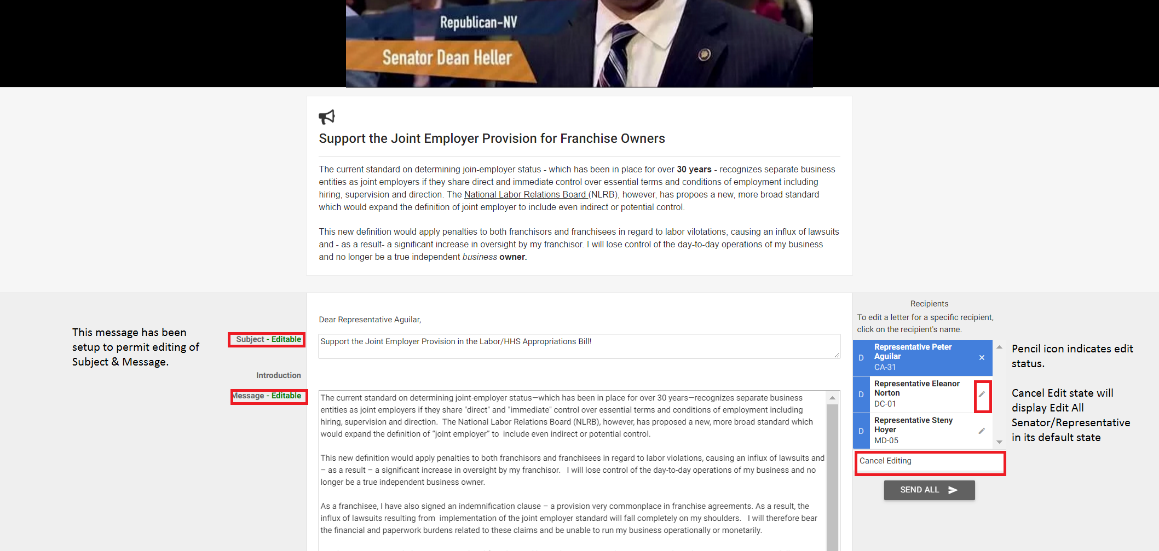

Taking Action - There are three distinct workflows for taking action Electronic (Email/Webform & Fax), Twitter and Phone. The user will select their preferred delivery method to expose the sample message that will be sent to the Legislator/Recipient(s). User may also edit one or more areas within the message based on the edit setting established by the Admin.

Messages sent via Email/Webform & Fax These messages types look and perform exactly the same. A sample message is displayed and user may modify if permitted by administrator.

The user may select Send All and all legislative targets will be sent message that was configured by Admin.

To edit a suggested message, the user will click on the recipient name or edit all recipients maintaining the same office type (House or Senate). When Editing All Legislators messages, message will be applied across all Advocacy Messages sharing the same chamber. Thank You messages will not respect user inputs and is set by administrator.

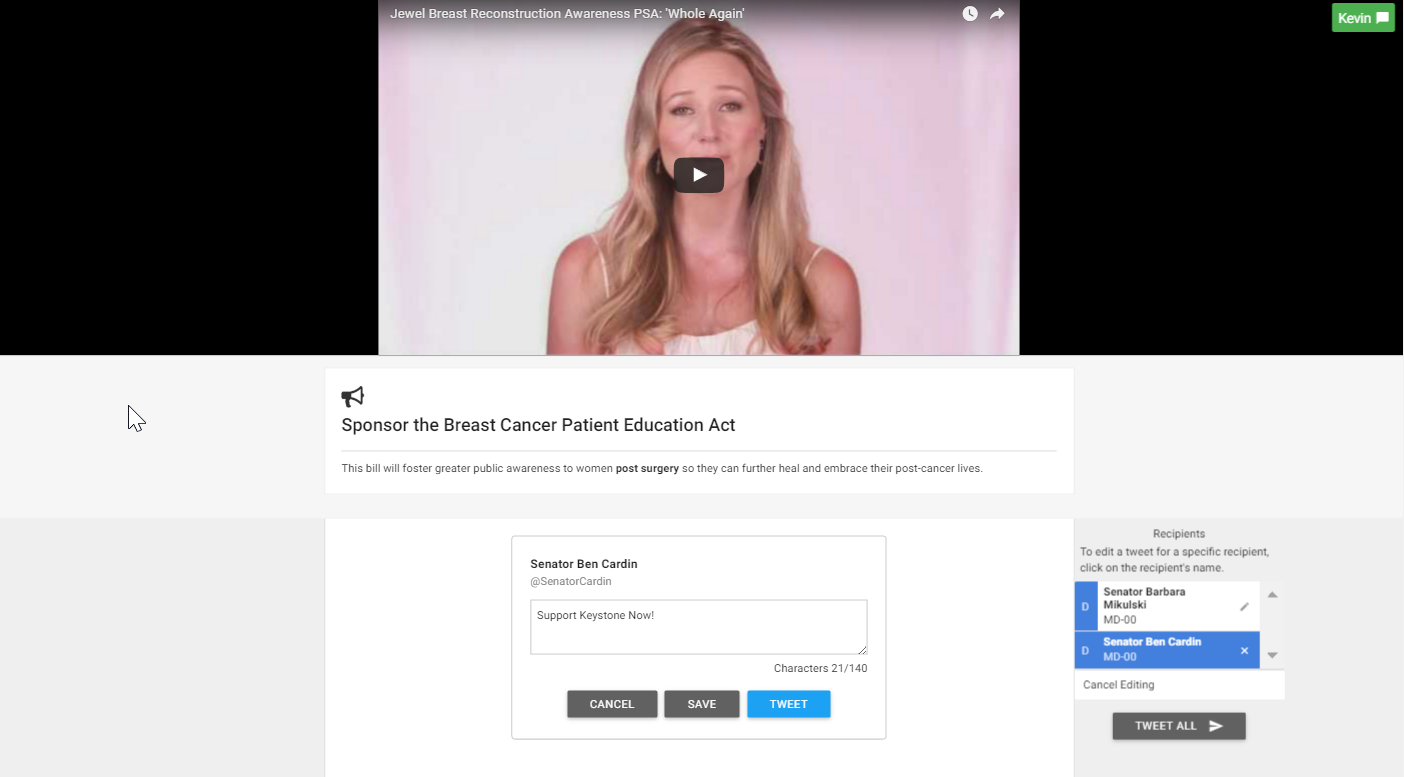

Twitter Advocacy A new feature in for Aristotle Advocacy is the ability to send an Advocacy message to a legislator's twitter handle. All rules associated with Twitter's character count will apply.

Process:

- The user will select the Twitter Icon from the available options to initiate Twitter advocacy workflow.

- Alert will display the following:

- Video/Graphic if present

- Title of the Alert

- Description introducing advocate to the advocacy topic

- Twitter Message created by Admin that may be sent immediately or edited.

- Alert will display the following:

- Action Options

- Tweet All Will send the sample Tweet that is displayed

- Twitter Authorization Screen displayed notifying user that the Aristotle Advocacy apps wishes to send Tweet on their behalf

- Authorize App is selected and Tweets are Sent

- Advocate See Confirmation Screen

- Receives Confirmation Message

- Tweet All Will send the sample Tweet that is displayed

Edit and Tweet- User wishes to modify Tweet for one or more Recipients

- User selects a Recipient Target to edit Tweet for selected target

- Sample Tweet is opened for editing

- User enters their content which may be Canceled, Saved or sent "Tweeted"

- User may select another target to edit

- Send Tweet

- Twitter Authorization Screen displayed notifying user that the Aristotle Advocacy apps wishes to send Tweet on their behalf

- Authorize App is selected and Tweets are Sent

- Advocate See Confirmation Screen

- Confirmation Page is Displayed Noting the following:

- Custom text provided by Admin thanking advocate for their participation

- Roster of legislators contacted

- Social Media Sharing Options is displayed

- Advocate Receives Confirmation Email

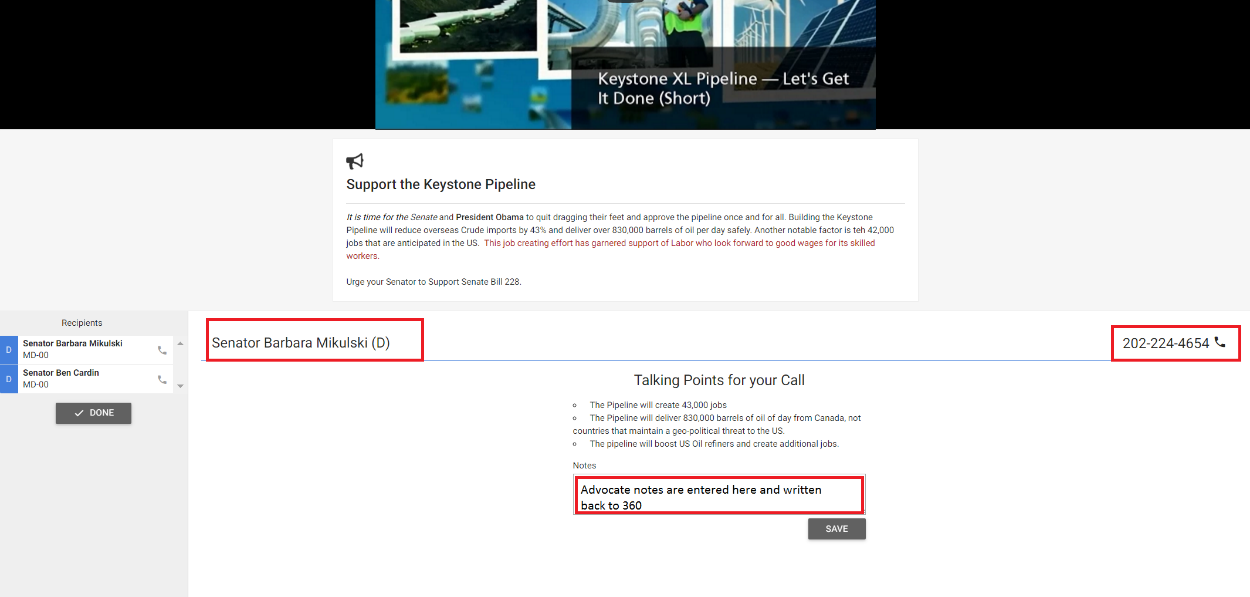

Phone Advocacy Phone advocacy is contained on a single page where the user will see Talking Points and Note capture.

Note: This solution is not VOIP based but will leverage SKYPE or Native Mobile dialer if available on device.

Process:

- The user will select Phone Icon from advocate contact options to initiate phone advocacy workflow.

- Alert will display the following:

- Title

- Video if present

- Talking Points

- List of Legislative targets/recipients

- Alert will display the following:

- User Clicks Legislator Name and Dials Number

- Note Capture is presented

- User Enter Calls Notes and selects Save

- Confirmation Message is displayed

- User Selects Done (Notes are written back to 360 in the both the individual and legislator record).

- Confirmation Page is Displayed Noting the following:

- Custom text provided by Admin thanking advocate for their participation

- Roster of legislators contacted

- Social Media Sharing Options

- Confirmation Page is Displayed Noting the following:

4.2. Action Center 3.1 User Guide

Action Center 3.1: Reference Guide for Creating Action Alert

Revised: 10/20/2016 to include new functionality

Action Center 3.1 builds upon our version 3.0 deployment when we simplified the overall advocate user experience, regardless of form-factor (Web, Phone or Tablet) so advocates may take action quickly and efficiently.

The Action 3.1 product provides a variety of User Interface improvements, better mobile experience and support for Twitter Advocacy. These improvements are based on inputs from a variety of stakeholders (internal and external), features desired by product management and additional refinements suggested by the development team.

4.3. Franchise Advocacy

Franchise Advocacy

Franchise Advocacy A new concept introduced by Aristotle is Franchise Advocacy. This permits the targeting of legislators based on the relationship between an individual and his/her linked organization for legislator matching purposes. Standard advocacy is dependent on the individuals home or work address that is matched to the legislator.

To enable Franchise Advocacy it is necessary to setup your data in 360 to establish a Franchise Relationship between your individuals to organizations. Once set, you simply need to set your alert to "Franchise" within Advocacy Model within the Action Alert Wizard.This will set your alert to recognize the Legislators linked to an individual's organization record as targets.All other targeting setup in the Alert Wizard will be enforced including Jurisdiction, State and Chamber.

Setting up your Data:

Franchise Advocacy is dependent on structuring your data in two areas:

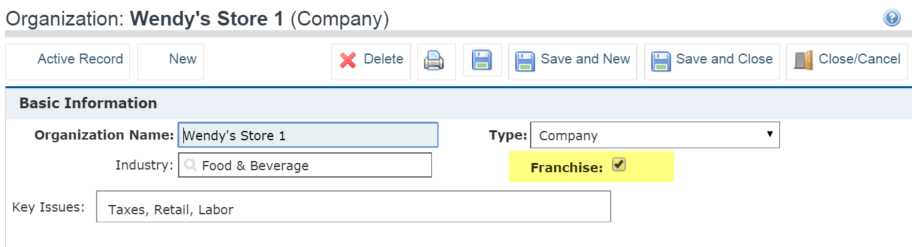

- Organization The organization must be marked as a Franchise in the check box. This can be done via manual entry, standard import or through a tech services request.

- Individual Record The individual must be linked to organization(s). You may link an individual to multiple organization to reflect the business interests. Multiple individuals may also be linked to multiple organizations. Process to set Franchisor (individual) to Franchise (Organization) Relationship

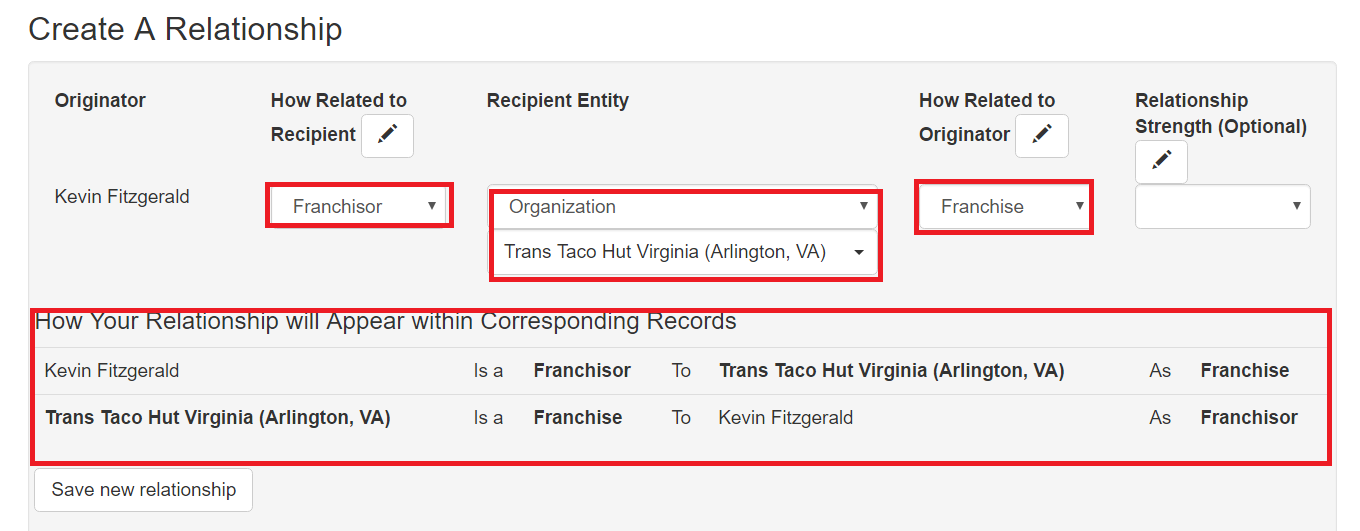

- From Individual Record open District Information, Relationships & Voting History Panel

- Select Add/Edit Relationship(s) next to Legislator & Other Relationships

- Set Individual IS A: "Franchisor"

- Organization

- After TO: Click Magnifying Glass

- Type: = Organization

- Find: = Organization Name

- Select Magnifying Glass to search

- Select Organization Name

- After TO: Click Magnifying Glass

- Related As: = Franchise

- Select ADD RELATIONSHIP BUTTON Please wait until you see the new relationship displayed in box

- Select Save and Close

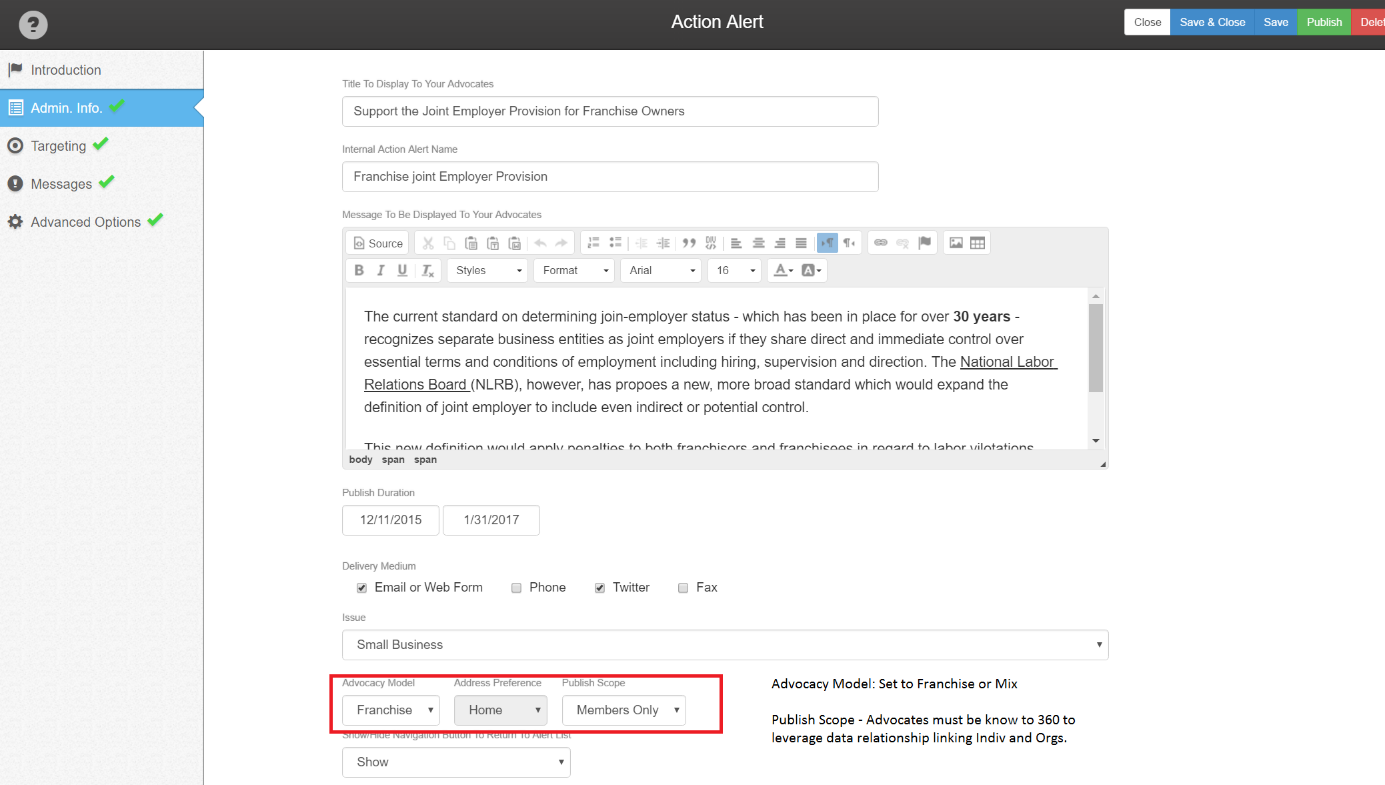

To Enable a Franchise Advocacy Alert in Action Alert Wizard The alert is setup as a standard action alert with the one exception of Franchise (or Mixed) being detailed within Advocacy Model

Steps to Enable

- Select Advocacy From Main Menu Bar

- Add Action Alert

- Admin Info.

- Select Advocacy Model

- Set To Franchise

- Will target Legislator(s) associated to individual's linked organization's address

- Address Preference will be disabled as Individual's address will not be factored when fetching legislator targets

- Publish Scope should be set to Members Only

- Will target Legislator(s) associated to individual's linked organization's address

- If "Mixed" Is Selected Both Standard and Franchise Model will be used.

- Will target Legislator(s) associated to individual's linked organization's address

- Will also target using standard methodology based on Individual's linked home or business address

- Set To Franchise

- Select Advocacy Model

- All other aspects of Action Alert creation remain the same as Standard Model.

5. Advocacy 3.1 - Regulatory Advocacy Administration

5.1. Overview

Setting up Regulatory Alert follows a similar method used to create a legislative alert. A notable difference is the requirement to setup a target Regulation first, so the proper regulatory target may be called into the Regulatory Comment Wizard.

The Regulation setup is a simple search calling www.regulations.gov to call your regulation into Aristotle 360. After setting up the regulation the Administrator selects add regulation and adds a minimal number of mandatory fields, (Internal & External) Alert Name, Description, start date, Regulation, suggested Content and Thank You content, and you are ready to publish.

Aristotle Advocacy will capture advocate submission and write back to the individual, Agency and Regulation. The advocate Receipt ID will be capture and written to the Individual's action so you can verify the submission on the Regulations.gov website using their basic search. An integrated Metrics report will detail all online actions associated to Regulatory Alert.

Please note: Aristotle Advocacy does support submission of both a standard text comment as well as uploading attachments for those advocates wishing to submit more detailed responses.

Button Behavior Action Center 3.1 incorporates commands at the top of the page that are dependent on the state of certain entries and will change based on the status of your Regulatory Alert. For Example: Save and Save & Close Buttons will not be available unless you have entered the minimal amount of data. (Titles, Message and Targeted Regulation) to save.

Unpublished View Button State:

Published View Button State:

Minimum Data to Save

- Title to Display to Advocates

- Internal Regulatory Comment Alert name

- Message to Display to your Advocates

- Targeted Regulation

Minimum Data to Publish

- Title to Display to Advocates

- Internal Regulatory Comment Alert Name

- Message to Display to your Advocates

- Target Regulation

- Comment

- Thank You Fields

5.2. Creating a Regulatory Alert, Step 1 - Create Regulation in Aristotle 360

Create a Regulation

Creating a Regulatory Alert, to capture advocate comments related to a regulation, is a two-step process. The first step is the creation of the Regulation. The second step is setting up the Regulatory Alert.

Step 1: Setup a target Regulation

Step 2: Setup the Regulatory Alert

Users may add one or many Regulations based on their search. These Regulations are used within the Regulatory Alert setup. When a Regulation is added it automatically builds Agency and contacts pages based on their association to the Regulation.

- Select Regulatory Menu Item

- Select Add Regulations

- Add Regulations Page Provides a search+ mechanism where users may call in one or more Regulations to be stored within Aristotle 360 and referenced by the Regulatory Alert.

- Keyword Search (Required) Users can enter a Keyword or Docket ID Number

i. Keyword

ii. Docket ID

- By Agency Acronym (Optional Filter)

- By Document Type You can search and add based on the following Document Types

i. Notice

ii. Proposed Rule

iii. Rule

- Open For Comment Filter to include only Regulations that are able to be used in Regulatory Alerts

Once search criteria is entered users select search and a list is displayed

User selects "Add Selected Regulations". Notification message appears confirming the Regulation addition or Notifying user that Regulation has been previously added.

The Regulation is now ready to be targeted for a Regulatory Alert!

Search for a Regulation

Aristotle 360 will store Regulation information as well associated activities.

To search for a Regulation previously stored in Aristotle 360 do the Following:

- Select Regulatory Menu

- Select Regulations

- Search Regulations A page will display list all regulations as well as search functionality

- Search By Field Supports a variety of searches within the dropdown box

i. Regulation Title

ii. Agency Acronym

iii. RIN

iv. Docket ID

2. Search (Required) Enter value associated to the Search By criteria selected

To view Regulation simply click on Regulation Title

5.3. Creating a Regulatory Alert, Step 2 - Setting Up the Alert

Setup the Regulatory Alert

As noted earlier, creating a Regulatory Alert, to capture advocate comments related to a regulation, is a two-step process. The first step was the creation of the Regulation. The second step is setting up the Regulatory Alert.

Step 1: Setup a target Regulation

Step 2: Setup the Regulatory Alert

Regulatory Alert Wizard

The Regulatory Alert Wizard is a Five Step process. The default page is an introduction giving you some quick insight on items that you may wish to prepare prior to setting up your Regulatory Alert.

Admin & Targeting This page supports naming the alert, message to display to YOUR advocates (not message being sent to Agency), Regulation to be targeted, start date and Publish Scope.

- Title to Display to Advocates This is the title of the alert displayed on the Regulatory Alert List Page and Regulatory Action Page. Typically this name is designed with the Advocate in mind and serves as a simplified call to action

- Internal Regulatory Comment Alert - This is the name that your office would traditionally refer to the Alert or Effort. It is not exposed to the Advocate. Typically this name is used for "In House" reference.

- Message to Be displayed to your Advocates This is a sentence or paragraph that serves as your call to action to your advocates! Typically they are designed as simplified overview of the Regulation with a strong call to action.

o Message is viewable by Advocates on the Regulatory List page

o Message is viewable by Advocates on Regulatory Alert Page

- Targeted Regulation The Regulation has been setup previously in the Add Regulation workflow. This is the regulation that your advocates will comment on.

o As you type the regulation(s) will appear. Click to select Regulation.

o Due Date: Is automatically set by the Regulation. Agency sets Due Date when they close the comment period. This is automatically enforced

- Publish Scope Restrict who may access and Act on the Regulatory Alert

o All Alert may be acted upon by any website visitor who enters registration information or is logged in.

o Internal Alert is accessible only via a link sent to users who are authenticated

- Address Preference Controls which address will be used to pass information to the regulations.gov webform when required by a particular webform. You may select Home or Business

- Show Button to Return to Alert List The show button controls a link that permits/denies your advocates to navigate to the Regulatory/Legislative Alert List Page (Action Center)

o Enabled: When enabled a link to return to Aristotle Action Center Alert List.

o Disabled: When disabled, users may only act on Regulation Alert displayed and may not navigate to other Alerts.

Comment Setup This page provides the Sample or Suggested Alert Comment that may be submitted to an Agency regarding a specific Regulation.

- Suggested Comment - The Suggested Comment is viewable by the Advocate and may be submitted to the Agency.

o Characters Remaining: Set at 5,000 characters by regulations.gov. Will count down as characters are added.

o Editable: The Suggested Comment may be edited by your users on the Regulatory Alert page. They may also elect to upload document(s) on the Alert page User Interface.

o Suggested Comment may be submitted directly

Advanced The Advanced settings provides the ability to manage instructional text and a variety of automated messages.

- Instructions This is free text where Admin may provide some instructions to Advocates on how to take action on a specific alert. Typically Instructions text focuses on submitting, ability to edit or upload a file.

o Viewable to Advocate

- Expired Message If your Advocates hits a Regulatory Alert that has been expired this message will notify them the Comment Period has ended

- Thank You Subject An automated email is sent thanking your users for taking action.

- Thank You Content This is the content thanking them for taking action

- Enable Confirmation Email A Confirmation Email is sent after the Advocate has submitted their Comment or upload the document

o Enabled Expands work flow to create Confirmation Email. Publish is not available until Confirmation Email workflow has been addressed

o Disabled Confirmation workflow is hidden and Administrator is able to Publish

- Sender's Email Address Enter email to appear as sender

- Sender's Name Common Name to display

- Reply To Designated email address for responses. Typically Administrator has a dedicated email box to capture these response apart from their normal email box

- Advocate Email Type Determine which email box you wish to send Confirmation Email to

o Default

o Personal

o Business

Video & Images This optional section permits you choose custom icons for the Regulatory Alert as well as embedded your YouTube video.

- Choose an Icon for the Regulatory Comment 200KB limit. You may upload or choose from existing icons stored within Aristotle 360. Place icon on Regulatory Alert list

- Embed a Video Show a YouTube video on the Regulatory Alert page

o Integrated for Twitter Sharing Video will be picked up when Alert is shared via Twitter

- Choose an image for Regulatory Alert Page Currently this place an icon on the Alert Page. This functionality will change in the future to support Infographics showing in place of the Video.

Social Media After your advocates have submitted comment they may share, when enabled, the Regulatory Alert via Facebook and/or Twitter. When enabled a bitly link will provide the ability for their social networks click and access your Regulatory Alert.

- Facebook - When Enabled the Regulatory Alert will be shareable on Facebook. User may setup Title and Post Description.

o Include Bitly link to Regulatory Alert

o Includes YouTube video if alert is configured

- Twitter When enabled the Regulatory Alert will be shareable on Twitter. User may add custom Tweet message. Please note that 140 character limits apply!

5.4. Regulation View

The Regulation view provides the Administrator with Regulation details that have been automatically added to Aristotle 360. Associated Alert and online Activities are added when a Regulatory Alert has been created and online actions taken using the Aristotle Advocacy Site.

5.5. Regulatory Metrics Report

Regulation Metrics Report will provide details relating to participation on a specific Regulatory Alert.

The Regulatory Metrics report will detail activity on your report that may be controlled by date range to drill down on specific dates ranges. The report will detail the following:

- External Title Alert Title exposed to your advocates

- Internal Title Internal Reference Title

- From & To Date Automatically defaults to the set values for the alert but can be modified by administrative users to drill down into the report

- Participating Advocates Number of advocates participating in alert Drill down will open universal list showing participating advocates

- Comments Delivered Number of comments submitted. Will open up list of Activities submitted

- New Advocates Number of new advocates that have not previously participated in an action alert. Drill down will open universal list of Advocates

- Activity over Time Chart showing Comment Submissions.

- Webform Submission via regulations.gov

- Email if webform is down our fallback delivery mechanism is using Regulation Contact email. Typically no email will be shown